Who decides after some years of the occupation to press again the school desk, always stands before the question about the suitable financing. On the one hand, one would like to maintain the accustomed standard of living, which was secured by the previous income. On the other hand, there are costs for the training itself, which can be of a considerable order of magnitude depending on the training measure.

Tuition fees, costs for teaching materials, examination fees and travel expenses are incurred, and together with the general cost of living, this results in a monthly amount that can be financed at reasonable conditions. The range of financing options is kept quite broad in line with demand, and depending on preference, prospective students have different options for financing their further education.

The KfW subsidy

Even at first glance, the funding programs of the Kreditanstalt fur Wiederaufbau (KfW) are striking. It supports further education in the form of a Master of Business Administration course (MBA) or any course of study with various student loans. Thus, KfW Program 174, the KfW Student Loan, addresses students who are looking for flexible funding. Eligible for funding are first or second degree, postgraduate studies or doctoral studies. Financing is possible without collateral, regardless of the student's own income or the income of his or her parents. The monthly payment amounts range from 100 euros to 650 euros, and can be chosen flexibly. The repayment is set as flexible. The loan aims to cover living expenses, and distance learning courses are also eligible for funding. The subsidy does not cover courses of study at a university of cooperative education or a course of study completed entirely abroad.

Students are eligible regardless of their income and the income of their parents if they are between 18 and 44 years old and are studying part-time, full-time or part-time at a state or state-recognized university in Germany. The interest rate is variable and is fixed at 01. April and 01. October for six months. The interest payment is deducted from the monthly disbursement, alternatively it can be deferred until the redemption phase. The maximum loan amount is 54.600 euros and for a study period of 14 semesters.

The KfW Student Loan can be supplemented with the KfW Program 173, the Education Loan. Although it is primarily aimed at students in the final years of their training or studies, it can also be combined well with a KfW student loan for further training. The KfW student loan is granted regardless of the income of the parents and the student's own income, and no additional collateral is required. It is aimed at financing living expenses during additional, supplementary or postgraduate studies. Eligible students are between 18 and 36 years of age, whose study duration does not exceed 12 semesters and who study at a college or university recognized under BAfoG (Federal Training Assistance Act). Students who are only studying part-time are not eligible for the subsidy. The loan is paid out in monthly installments of 100 euros, 200 euros or 300 euros.

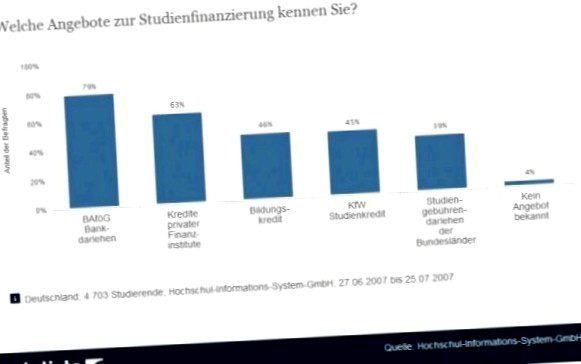

Which student financing offers do you know about? > The statistics show the results of a survey on awareness of loan offers for financing studies. 79 percent of respondents knew about the BAfoG bank loan. (Source: Statista / Hochschul-Informations-System-GmbH)" width="600" height="393" />

Banks grant classic installment loans

If you have been working for a while and want to boost your career at the age of 45 or above by studying for a postgraduate degree (e.g. MBA / Master of Business Administration), the above-mentioned KfW further education financing is not an option for you – the favorable, subsidized financing simply fails here due to the regulations on maximum age. People over the age of 45 who are interested in further education are therefore dependent on other solutions and in most cases end up with their house bank. Because: Also nearly all banks and savings banks offer classical installment credits for the financing of a further training. These are usually advertised under the name student loans. However, one must be aware that the conditions may seem advantageous at first glance, but they are always based on the current interest rates for consumer loans. It is also important to know that such a loan is to be repaid at the latest after the completion of further education. Unlike in the United States, bank financing of MBA programs and advanced studies is still in its infancy in Germany. Cost-effective and flexible offers from banks would be highly desirable at this point. If one decides nevertheless for the admission of an installment credit, the condition comparison is indispensable before the contract conclusion. This is the only way to identify the bank with the most favorable interest rates and the most flexible loan conditions, which exactly fit the individually required financing. On the website of Kredite.net website you will find a detailed description. The credit offers of Creditplus Bank, Barclaycard and Norisbank are currently recommended as the "top 3 providers".

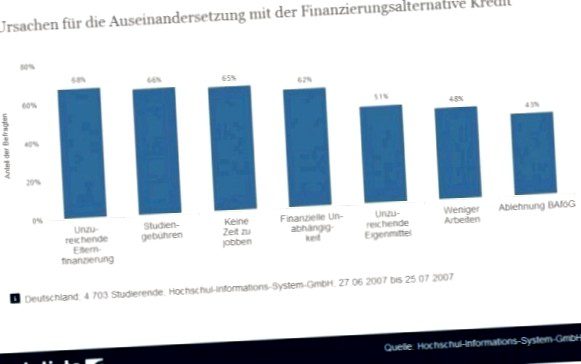

The statistics show the respondents' statements on the reasons why they thought about financing their studies through loans. 68 percent of respondents cited inadequate funding from parents as a reason for considering student loans. (Source: Statista / Hochschul-Informations-System-GmbH)" width="600" height="393" />

The education fund as a private offer

A fairly new concept for financing continuing education studies is the education fund. It is organized as a fund concept in the private sector and aims to cover living costs, tuition fees and necessary stays abroad. The repayment takes place in dependence on the respective income, already before the beginning of the further training a percentage is specified, which is deducted over a certain duration from the later monthly income. For the financing from an education fund neither interest nor repayment result in the classical form of the bank credit.

Financing through scholarships

At German universities as well as at foreign universities there is the possibility to receive a scholarship for the financing of studies. Such scholarships can be linked to a specific continuing education program, but they can also be granted independently of it. Each institution sets its own requirements for admission, but they usually include excellent performance in previous studies, and often will also require involvement in social or political activities.

Sponsoring is very similar to a scholarship and can currently be found in large international management consultancies in particular. There, employees have the opportunity to have their participation in further education financed by their employer. In most cases, sponsorship applies above all to MBA programs, which are designed as either full-time or part-time studies, or even as distance learning programs. In German companies, such sponsoring programs are currently still rather in the development stage, but are becoming more and more popular with employers.

Financing continuing education with loans from private sources?

Within many families, it is often common for financial bottlenecks to be bridged by other family members during phases of education and training. In most cases, parents step in here and provide an interest-free loan to the younger generation. But it's not always possible everywhere, especially since professional post-graduate education such as z.B. an MBA study at a renowned business school also gladly once 50.Cost EUR 000 and more.