Finding the right bank for construction financing is a major challenge for many people. Usually numerous appointments are made with different credit institutes, which take up much nerves and time. Often it is only a matter of the one decisive question:

"Which bank has the most favorable interest rate?"

However, this question is not so easy to answer across the board.

Interest rate – the bank comparison

In the following example of a sample customer, which we created on our calculation platform of the real estate loans, we would like to show how an interest rate difference can look with different banks. The focus here is the so-called fixed interest rate. Fixed interest rate means the term that the bank grants the customer with regard to a certain interest rate. Long fixed interest rates usually result in an increase in the interest rate.

Key data: The sample customer in our example is married and has an average household income. The purchase price of the house is 300.000 €. This incurs additional costs amounting to 21.000 € to. The equity capital employed is 50.000 €. Accordingly, the loan amount to be borrowed is 271.000 €.

Fixed interest rate 15 years

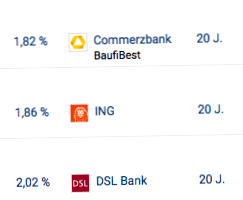

20-year fixed interest rate

The graphics represent a simplified overview of our credit platform. In our example, we have included in each case the first three credit institutions with the most favorable interest rate in the selection. The left column of the figures shows the offered debit interest rate. In the middle the corresponding credit institutions are shown. The right column illustrates the fixed interest rate in years. The first graph illustrates the comparison of the 15-year and the second that of the 20-year fixed interest rates.

It becomes clear that already with the input of different interest rate fixings the order of the most favorable offerer changes. (date from October 2019)

Which bank has the most favorable interest rate?

If Deutsche Bank is the most favorable option for a 15-year fixed interest rate, Commerzbank appears as the bank with the most favorable interest rate conditions when you select a 20-year fixed interest rate.

This simple example quickly shows the effects that the change of only one parameter has on the financing project.

This makes it impossible to determine in advance exactly which bank offers the "best" interest conditions for the customer. You can certainly imagine that there are numerous variations and preferences among customers, which can lead to different interest rates among banks.

The following are examples of which parameters can also have an impact on the interest rate:

– the valuation of the property- the amount of equity used- the option of unscheduled repayment- the length of the interest rate commitment- the amount of the repayment rate

Is it worthwhile to compare the interest rates of different banks?

In the above chart, the interest rates do not differ dramatically at first sight. For this reason, it happens that we encounter opinions such as:

" 0,1% more favorable building financing interest with another bank does not make nevertheless much difference. "

"0.1% more favorably – for it I change nevertheless not from my house bank to another bank. "

This opinion can quickly become very expensive, because 0.1% interest rate difference can make a big difference!

Another example: A customer wants a loan of 300.000 € for his real estate financing. Due to the favorable interest rate level, he decides on a long-term interest rate security of 25 years. Bank A makes him an offer with a 25-year fixed interest rate and an interest rate of 2,45. Credit institution B, on the other hand, charges 2.55% for a 25-year fixed interest rate period. The buyer pays a monthly financing rate with both credit institutions of 1.140 €.

Financing bank A with 2.45% Financing bank B with 2.55% Remaining debt after 25 years: 81.967,30 € remaining debt after 25 years: 89.430,98 €.

Difference: 7.463,68 €

Even with this simple example, it becomes clear what an essentially minimal difference in interest rates causes in long-term interest costs. Interest rate differences of far more than 0.1% often occur with long fixed interest rates, and the financing amounts are also frequently higher than 400.000 €.

Result: An interest comparison with different banks is worthwhile itself. Which bank can offer "the most favorable interest rate" always depends on the individual case and requires expert advice in advance.

What added value can we offer?

The ways to the different banks are laborious and cost a lot of time.

We do this work for you!

As independent financial advisors, we are not tied to a single bank, so we work with a large number of regional and national banks, insurance companies and building societies in the area of construction financing.

Through our years of experience in the construction financing sector, we can conveniently compile the most attractive interest rate conditions and financing options for you, which saves you the work of obtaining offers from various banks yourself.

- favorable loan interest (often more favorable than the own house bank)

- flexible scheduling (even after the bank's normal opening hours)

- Us, as a direct contact person on site in Bad Essen

- large selection of financing options

What costs do you incur and how do we get paid??

We advise you free of charge and without obligation, to what extent a financing is possible and reasonable for you. Thus, together we can answer the question for you: "Which bank has the most favorable interest rate??".

If we are able to arrange financing for you, you do not pay any additional consulting fees.

We receive this directly from the relevant bank/insurance/building society and it is not charged separately.

If no financing is obtained after our consultation, you also pay no consulting fee! Thus you take absolutely no risk and can get advice without obligation.

If we have piqued your interest and you are interested in a free and independent consultation, please feel free to contact us at. You can do this using the following input form.

You are also welcome to ask us further questions in advance or to ask for feedback regarding an appointment.

In any case we are looking forward to your inquiry.