The first step is to compare: if you want to buy a property or plan to build a new one, you have to deal with financing issues. In addition to determining one's own financial possibilities, the selection of the financing bank is the most important building block. And, of course, the bank should offer the most favorable construction financing tailored to one's own possibilities.

An initial interest rate comparison is a good indicator of what is possible. The accedo AG offers on your website www.accedo.de now the possibility to query online current real-time data of more than 450 banks. This will give you a quick overview of the current interest rate offers. These are approximate values, which must then be concretized in a telephone consultation. We recommend the interest rate comparison calculator to all those who are in the process of obtaining an overview of construction financing. So you will be surprised how close these values are to the actual interest rates offered after the complex construction financing concept has been created. Try it out.

Compare interest rates in a few minutes

To quickly get a result that you can use as a guide, you need to visit the following website: Real-time interest rate comparison calculator

On this home page, you will find a triangle at the top center with a link to the construction interest calculator ("calculate now"):

Use the accedo interest comparison calculator to compare the top construction loan interest rates of 450 banks in real time.

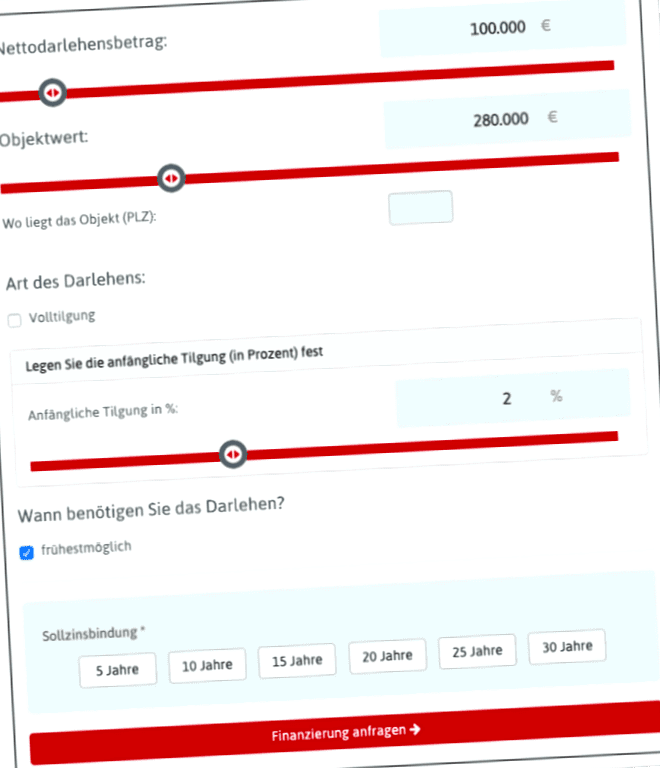

After you have used the link, you will be taken to the calculator page. Here you need to enter a few financing data such as

- the amount of your desired loan

- the approximate property value (purchase price or. Costs of new construction)

- the zip code of the location of your desired property

- the desired initial repayment of the construction financing

- as well as the time of the loan disbursement

With these few details, the interest rate comparison calculator is able to give you information about the interest rate as well as the term of the construction financing.

The result of the interest comparison calculator

You get an instant overview of the banks that would take over your construction financing and get the top offers of the lowest interest rates at the current time of entry. With this information you already have good reference points that will help you in your purchase decision.

The simple interest comparison form, which is however a crucial decision-making aid for you.

In the end, you still need to choose the desired interest term (5, 10, 15, 20, 25 or 30 years). This term of the fixed interest rate is the decisive factor that determines the amount of the offered interest rate. Short fixed interest periods (5 years) are always more favorable than long-term loan agreements. But the differences are not that big in the current low interest rate phase. We recommend to count rather on longer fixed interest rates, since you can finance in such a way normally more surely, because you can secure the mini interest on a as long as possible period of time.

A tip: Vary the terms so that you can immediately see how this changes the interest rate, monthly installment and total term. And also note the amount of the residual debt shown. The residual debt is the amount that is still due after expiration of the fixed interest rate and must be serviced later with follow-up financing.

Vary the terms to see at the end how the term affects the interest rate and remaining debt. This way you can easily decide which term seems to be the best for you personally.

Instant overview: The best interest rate offers from over 450 banks in comparison. To the calculator

First compare interest rates – then seek advice

Although the interest rate comparison is an excellent guide for decision-making, it is no substitute for an intensive consultation with a proven construction financing expert. Because in addition to the interest rate, many other factors play a role in determining whether you get the best construction financing possible. This includes low-interest loans, building savings plans or flexible financing, as well as creditworthiness, collateral or the region in which you want to purchase a property.

These factors ultimately also affect the interest rate. Also important are the "soft" factors, which vary from bank to banbk but cannot be represented by any calculator. These include z. B. the amount of the maximum and free unscheduled repayment options, the question of the provision interest-free period (particularly important for new construction, since here it is not possible to estimate exactly when the loan will be drawn down in full (z. B. Because individual trades take longer than planned). The longer this period is granted the better, because this way you avoid the risk of having to pay uncalculated commitment interest after all.

Not only comparing interest rates is advisable – comparing providers is also important. Do not rely only on your house bank. Use the bank-independent consulting services of construction financing brokers like accedo AG. The latter use a network of more than 450 banks and also receive better interest rate offers than private individuals due to the high construction financing volumes involved. This is why it is not uncommon for the interest rate offered by an intermediary to be better than that offered by your bank. And this despite the fact that the commission is already included in the offered interest rate.