Even though valuations for tech and FinTech companies have been under pressure in recent weeks, and the slump in crypto stocks in particular has caused a stir, the FinTech market as a whole will continue to grow and remain attractive to more new, innovative companies. Despite all the developments in recent years, payment processes can still be further optimized. Customers want more transparency and overview of their financial situation, and the financial industry's offerings can be even better integrated with those of other providers.

But aren't the days of young, so-called challenger banks already over? What will be the offering of the next Challenger Banks? How can a challenger bank quickly prove that there is a market for its offering? And then how do you identify your new customers efficiently and easily?? This article answers the questions and puts forward some thesis on the matter.

Challenger banks benefit from the implementation of new development methods

Challenger banks benefit from the implementation of new development methods, low hierarchies and the uncompromising use of modern technology: Challenger banks are relatively small and young banks that compete with traditional banks and differentiate themselves from them in particular by using financial technology, such as online-only account access, d.h. The absence of (physical) branches. In this respect, there have always been "challenger banks". However, there has been an increase in start-ups in this area over the last decade, which have been able to grow rapidly through rigorous use of the opportunities offered by digitalization.

Often, the focus here is on a customer-centric banking app designed to make it easier for customers to keep track of their finances and conduct banking transactions. A concentration on certain topics, such as payment transactions, securities trading or the custody and trading of crypto assets is also typical.

An important advantage of challenger banks compared to established banks is that they do not have to build on existing, possibly older ("legacy") IT systems and can set up processes digitally from the very beginning. They also often take an agile approach to development, d.h. using Scrum project and product management, which makes development faster and more efficient overall.

This allows a rapid realization of new products and a focus on customers and their needs.

Challenger banks must be credit institutions

Challenger Banks must be credit institutions if they want to provide banking services themselves or call themselves a bank: If a challenger bank wants to provide banking services and call itself a "bank," it must have a license as a credit institution under the German Banking Act (KWG).

This requires Challenger Bank to have a management team that has the appropriate experience, in terms of professional suitability, sufficient capitalization (at least EUR 5m) and a proper business organization. All of this requires significant investment of capital and time, most of which is not available to a startup. In particular, the problem arises that a challenger bank with an innovative business model has yet to prove that there is a market for it, d.h. That it can attract customers and, in the long run, will make a profit. There is the danger that one builds up an organization with considerable expenditure first, only to find out that the business model is not sustainable, when one goes to the market with the permission.

Banking as a Service allows challenger "banks" to offer banking services to customers

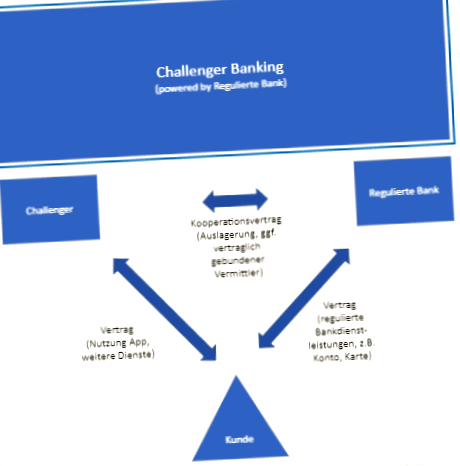

Banking as a Service allows Challenger "banks" to offer banking services to customers without being a bank themselves: This is where the Banking as a Service (BaaS) model helps. Instead of becoming a bank itself, the Challenger Bank cooperates as a partner with an established bank. The partner can concentrate on acquiring and maintaining contact with his customers, while the bank, in the background so to speak, takes care of the banking business.

The partner is therefore responsible for customer acquisition, for example with the help of advertising and digital campaigns. It develops and operates the banking app and website through which to communicate with the customer, and it provides (first level) customer service to assist the customer with questions. The bank, on the other hand, is responsible for the actual banking business, for example account management, card business and payment transactions. The bank, or another regulated institution (hereinafter also referred to as a bank), may also offer, for example, securities trading, crypto securities trading and crypto custody, loans and foreign currency transactions.

From a legal point of view, this presupposes that the customers are customers of the bank for the banking transactions, i.e. that they conclude a contract with the bank. Even if the offering to the customer is primarily provided under the partner's brand (z.B. by using the website designed and operated by the partner), it must still be disclosed to the customer on the website and in other communications that his contractual partner for banking services is the bank, not the partner.

From a regulatory point of view, it should be emphasized that the bank is not subject to any instructions from the partner within the scope of its services to customers. For example, when it comes to the question of whether certain customers should be accepted, whether loans should be granted, or whether the contractual relationship should be terminated, the bank is allowed to decide freely. In this context, the partner's offering largely represents an outsourcing of activities and processes that are essential for the performance of banking transactions. To the extent that securities services are provided in addition to traditional banking services, the partner usually acts as a contractually bound intermediary. This requires an even closer connection. Both as an outsourcing service provider and as a contracted intermediary, the partner is subject to the bank's instructions.

Banking as a service can therefore refer to the complete range of services offered by banks and securities institutions. Often, however, the partner will only want to offer a customer individual regulated services, for example payment services, credit cards or securities transactions. If, in this respect, not credit institutions but payment service providers (such as, e.g., payment service providers) are involved, the customer shall be informed of the fact.B. payment institutions or e-money institutions) or securities institutions act for the partner, one can speak of BaaS in a broader sense.

There will be an increasing number of challenger banks in the area of vertical banking

There will be more Challenger Banks in the field of vertical banking and embedded finance: In practice, it can be observed that the establishment of challenger banks in the sense of providers of banking services to the general public is decreasing significantly. A certain saturation of the market is also likely to have occurred in the area of securities trading and crypto securities trading. However, this does not mean the end of BaaS.

Instead, there are more and more (also international) providers of BaaS. As a result of recent start-ups, offers for specific customer groups (e.g., customer loyalty) are now increasingly being made available.B. certain professional groups, genders, age groups) on the market. This is referred to as vertical banking, because it attempts to offer financial services to a specific market segment according to their needs and in full scope. This is expected to result in an improved offer for the customer, because it is tailored to his needs. It also offers the possibility of adding other products (such as.B. insurance, loans, factoring) offer, which may be. Offer higher margins than traditional banking.

Another development for BaaS is what's known as embedded finance. This is where (regulated) banking and financial services are integrated into the offerings of other companies, such as.B. Payment options, store credit cards or financing and insurance for the product purchased online. Again, the company in question will not want to be subject to regulation itself, but will use a BaaS provider instead. As diverse as the possible services are, as diverse are the possible BaaS providers, which do not necessarily have to be banks in the sense of the KWG, but can also be securities institutions or payment service providers, such as e-money institutions, for example.

Dynamic growth in identification options under money laundering laws

Both in terms of supervision and technical offerings, there is a dynamic evolution in identification options under money laundering laws.As BaaS partners offer a digital product to customers, and most want to grow quickly, BaaS providers must also make their services digital as much as possible (d.h. Offer without media disruption) so that prospects can become customers as easily as possible.

One challenge here is that banks need to assess their new customers according to. Have to identify themselves according to European and German money laundering laws. While this used to be done by presenting an ID card at the branch, video identification is now common for online banks. But it's also possible to identify yourself with the eID function of your ID card, or with a qualified electronic signature, although you still have to make a reference transfer from your own existing bank account.

Also, electronic identities can be quasi-stored for customers by banks or other providers so that, for example, banks can rely on previously made identification when opening accounts. In this area, we are currently seeing European regulators taking a closer look at the issue, and providers are also working to improve it. Development on this is also critical to, and dependent on, success in digitizing public administration and healthcare.