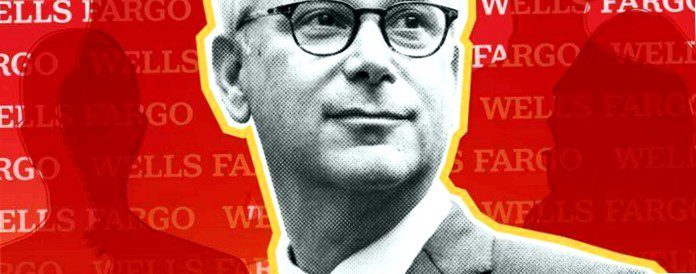

The road to victory was not an easy one for Charlie Scharf.

Scharf, 57, was put in charge of Wells Fargo in 2019 to help the San Francisco bank emerge from a series of consumer scandals. During that time, he has made some big moves, including overhauling the bank's leadership and strengthening compliance. But the nation's third-largest bank continues to be beset by controversy.

Despite Scharf's efforts, Wells Fargo was accused in June of conducting mock interviews with women and non-white candidates for jobs that had already been given to others. In March, Bloomberg said the bank engaged in discriminatory lending practices, which Wells Fargo denies. It also recently fired dozens of loan officers it accused of inappropriately changing property appraisals in its internal system to trigger a waiver of appraisals.

Sharp was set up specifically to help the bank overcome a series of scandals that began with regulatory fines in 2016 for opening fake accounts. The fake accounts scandal led to a Federal Reserve asset cap, which the bank is still subject to, limiting its growth, while Scharf has pledged to cut the bank's costs by $10 billion.

Here's a rundown of what's happened since Scharf took the helm, including layoffs and firings, hiring problems and what the bank's leadership looks like now.

How Scharf makes changes

Scharf has fundamentally reshaped the bank's leadership since becoming CEO in 2019. Wells Fargo has hired more than 90 top executives from outside the bank during that time.

Wells Fargo has also "drastically changed" the way it runs its $2 trillion wealth management business, Scharf said at a recent industry conference. He said the goal behind some of the moves has been to provide more consistent services and products to investors and customers.

Scharf has also said he plans to expand businesses that will put Wells in direct competition with banks such as JPMorgan and Goldman Sachs, including credit cards and investment banking. At the same time, Scharf said in June, he plans to scale back the construction financing business.

And some employees are taking direct action to fix problems at the bank. While Scharf aims to lead Wells Fargo over hurdles, a union campaign is unfolding at the bank that had about 300 supporters as of June.

Read more:

Why a growing group of Wells Fargo employees is fighting for the first major union in finance, where 1% of workers are unionized

Wells Fargo CEO Charlie Scharf said the bank is considering pulling back parts of its mortgage business in light of the review of its lending practices

Wells Fargo, Main Street banker, pulls back from mortgages. Analysts break down the 4 main factors driving this unexpected strategic shift.

Wells Fargo CEO Charlie Scharf has called the change in the bank's leadership a "dramatic shift". Here's our exclusive look at the new hires of nearly 90 seniors.

Wells Fargo CEO Charlie Scharf on how the bank is overhauling its $2 trillion wealth management division

Mortgage layoffs, layoffs

Wells Fargo laid off home loan employees in at least five major markets in April as the Federal Reserve began ticking interest rates higher. The bank had reported in April that its home equity income fell to $1.5 billion in the first quarter, down 33% from the same period a year earlier.

In May, Insider reported that Wells Fargo had fired dozens of loan officers accused of abusing so-called appraisal waivers, which give borrowers and their loan officers the right to bypass a home appraisal for mortgages originated by lenders like Wells Fargo and sold to Fannie Mae or Freddie Mac if the loan meets certain conditions.

The bank terminated the employees "after a thorough investigation revealed they had engaged in misconduct," a Wells Fargo spokesperson told Insider. But some loan officers protested the terminations, telling Insider that some of the incidents dated back to the first half of 2020 and that guidance from senior managers was not clear at the time.

Read more:

Wells Fargo has fired dozens of loan officers accused of abusing appraisal waivers. Some say the bank has given them mixed signals.

Because of this, high-flying mortgage startups like Better and traditional lenders like Wells Fargo are laying off thousands of employees – and it could get much worse

Wells Fargo's housing division hit by layoffs as mortgage rates rise and lending declines. Teams in several U.S. cities may be affected.

At Wells Fargo's town hall, in which a top executive told employees, "I love each and every one of you," while explaining that layoffs in housing finance were inevitable

Review of lending practices, hiring

In March, a Bloomberg report revealed this Wells Fargo rejected more than half of black homeowners' refinance applications in 2020. A Wells Fargo spokesperson told Insider in June that they are "confident that our underwriting practices are consistently applied, regardless of the race or ethnicity of the customer".

The spokesman added that Wells Fargo financed "twice as many loans overall" to black borrowers in 2020 as the next largest bank, when loans originated and purchased from related vendors were included.

Then, in June, the New York Times reported that Wells Fargo had been conducting mock interviews with women and nonwhite candidates for jobs that had already been given to others, according to interviews with several current and former employees interviewed for the story. The staff allegedly did this to meet diversity requirements on paper, the report says.

A Wells Fargo executive told Insider that the company's diversity rule – which requires 50% of all job candidates to be from an underrepresented background – has helped increase diversity at the company.