Bernhard, how much house can I finance? Please help me to get a good house financing with which I can buy my dream house. How much house can I afford? Income, expenses, budget math, and what really matters to get the best financing.

Bernhard, how much house can I finance? Please help me to get a good house financing with which I can buy my dream house. How much house can I afford? Income, expenses, budget math, and what really matters to get the best financing.

Many students take college courses with the assumption that higher course grades will mean a guaranteed transfer later on. This may be true, or it may mean a lot of extra work for nothing. Can you determine which classes are likely to transfer based on the course number so you don't waste a lot of time and money on classes you don't need? The answer to this question is complex and may depend on how your current school assigns course numbers, how your transfer school views these designations, and your final grades in these classes.

If you view a college catalog, you will notice that courses have designations such as MATH 093, CHEM 110, HIST 215, etc. Have. While the reason for these designations may vary from school to school, they should give applicants an idea of the complexity of the material on offer. In an interview with the Seattle Post-Intelligencer, Dr. Kelly S. Meier explained grade level simply: In general, lower numbers mean lower learning levels and fewer prerequisites. They may also mean more competition for class space, especially if you're just starting out.

Owning your own property is like having a job: it should suit your type of person. Those who are at the beginning of their career like to look for helpful tips to help them decide on their career direction. If you answer the questions in our tests conscientiously and honestly, you will get interesting clues about your wishes and desires, which are hidden deep inside. It is exciting to deal with such analyses, because you can use them to get to know yourself better. A little self-reflection does not hurt in such important matters as the right career choice. Similarly, when it comes to other major decisions such as buying your own home. In order for you to feel comfortable in your own property for many years, two prerequisites must be met. You need to find your dream home, and you need financing that suits you for the long term. To find this financing, you need individual advice.

In order to reliably protect buildings from wind and weather, roof renovation is due every 30 to 50 years. It is worthwhile insulating the roof even beforehand. Because in this way the heat losses sink. Heating costs are lower and living comfort increases. The special thing about it: In combination with insulation work, homeowners get an attractive subsidy for roof renovation. We explain how much this amounts to, what requirements must be met and how to apply for financial assistance in the following sections.

You can find these topics in our article:

Quick & cheap rescheduling with our loan comparison!

In the meantime, one in four consumers in Germany has taken out one or more installment loans. Very many borrowers, however, pay more interest than would be necessary. Especially if many individual small loans must be repaid monthly, the total costs are enormous. It would be much more favorable to combine these loans into one large debt rescheduling loan.

Having money and getting money is one of the most difficult activities in the life of an entrepreneur. So it is not surprising that the topic of loans and borrowing money for the self-employed is a constant topic. If you are interested in a loan for self-employed people in Austria or want to know something about a loan for self-employed people and entrepreneurs in general, we recommend the following article.

[maxbutton >

If entrepreneurs who need to know everything pre-funded in their business have money worries, then they need to think about a loan for self-employed in Austria. This loan for self-employed people in Austria is usually not as easy to get as it is in comparable neighboring countries or as it would be the case if you were an employee. A loan for the self-employed and entrepreneurs is often subject to hard and difficult to meet conditions, because there is a higher risk of default for the lender. Thus, especially entrepreneurs are dependent on getting a loan at the given conditions: But what if you have had problems in the past and have no collateral for payment?

Dar es Salaam (IDN/afr). Mwajuma Ramadhani steers her cab through the vibrant streets of Kariakoo district. Suddenly a motorcyclist cuts her off. Ramadhani is just able to swerve to the right and bring her vehicle to a stop. "You would have caused an accident if I hadn't been so careful," she shouts at the biker as he stares at her in perplexity.

A motorized two-wheeler opens ways into wide worlds, of which numerous people dream for many years of your life. The dream of a motorcycle with plenty of horsepower and seating comfort on all tours can be financed with an affordable loan.

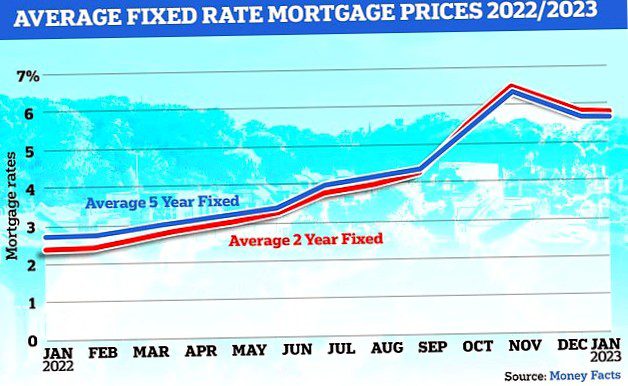

Last year was a tumultuous one for mortgages, none more so than after then Prime Minister Liz Truss' mini-budget in September.

A second mortgage is simply a loan taken out after the first mortgage. There can be various reasons for taking out a second mortgage, such as z.B. Consolidating debt, financing home improvements, or covering part of the down payment on the first mortgage in order to avoid the mortgage insurance (PMI) requirement. The second mortgage, secured by the same assets as the first mortgage, usually has a higher interest rate than the first mortgage. The amount that can be borrowed is based on the equity of the home, which is the difference between the current value of the property and the amount owed on it. Another option, if there is enough equity, is to refinance and take out a loan that exceeds the current loan balance.